What Is The Logic Behind London Council Tax?

The theory seems to be that moving into a cheaper area of London means both cheaper properties and a lower rate of council tax. Unfortunately, this rarely turns out quite how many assume it will. When faced with the cut wrenching truth that the lowest rate of council tax is Westminster, many of us are faced with a decision we hoped would never arise. At least not in our lifetimes. We must choose to pay more tax.

But… if council tax in Westminster and City of London is so low, everybody should try and move to Westminster!

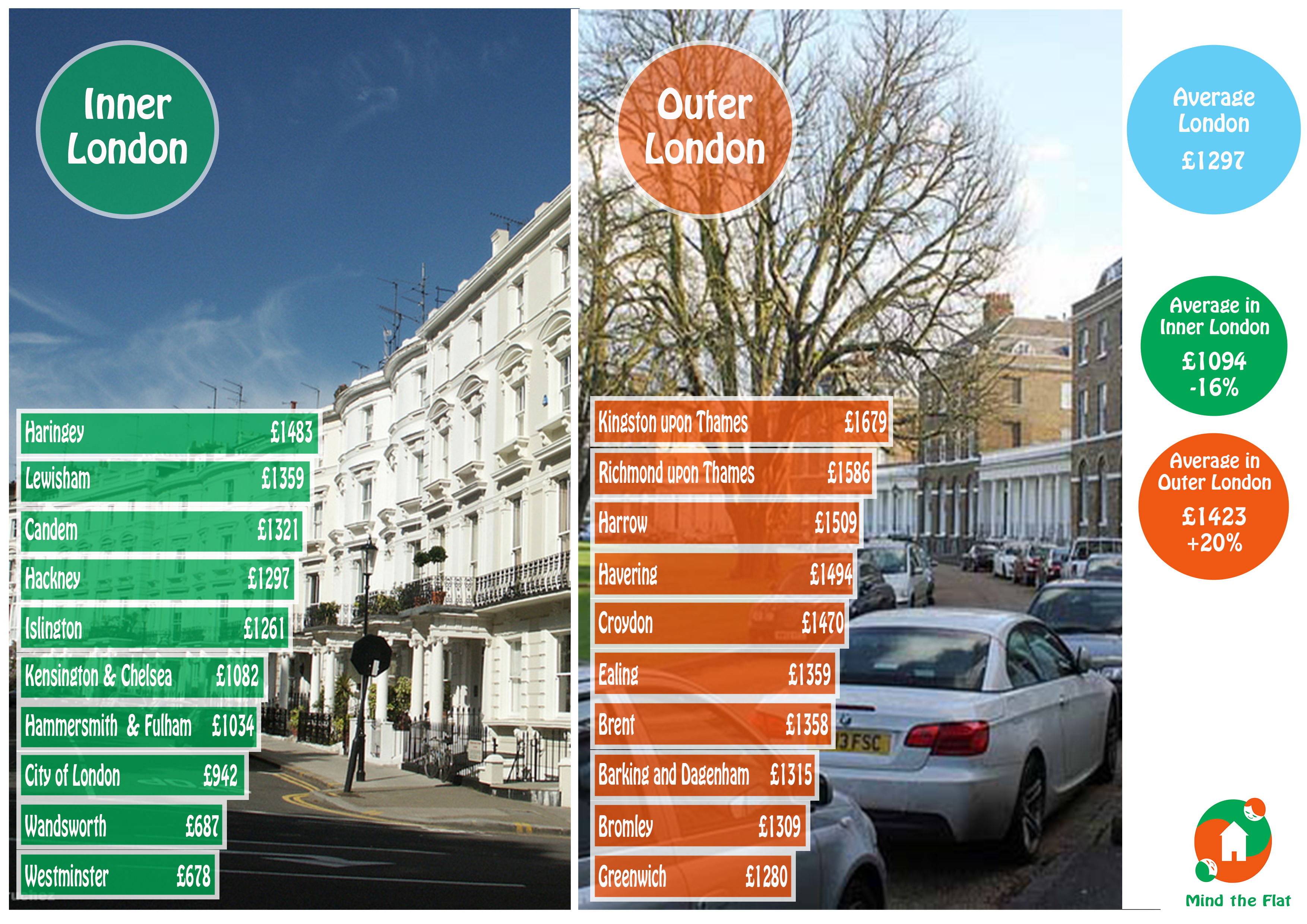

Well, if the only thing you care about is having the satisfaction of paying a few hundred pounds less on tax per year, then sure, go move to Westminster. I suspect however that you will probably be paying those few hundred pounds you saved in Council tax on income tax. The average 2 bed rental price in Westminster is £2,442 making it the second most expensive place to live in London after Kensington and Chelsea.

You could be forgiven for thinking that the rates of council tax around London seem rather unfair. The Queen (living in Buckingham Palace) will pay £75 less Council Tax per month than a 2 bed semi-detached house in Bexley. The average house price in the Queens borough of Westminster is £730,000 – the average house price in Bexley only £225,000.

Council tax on property in London has been worked out based on the relative open market value on the 1st April 1991. This can go part of the way to explaining why some currently very wealthy areas have lower council tax rates than other areas. Westminster house prices have increased 131% in the last 10 years alone meaning that while the council tax bands may have been fair in 1991, since then however, some of them have increased exponentially.

However, this is only scratching the surface of the issue. The fact of the matter is that Local Councils do actually have the power to change the amounts of council tax that we pay.

Council tax is one of the best known and most obvious taxes in the country. Being able to significantly cut it, immediately makes an area appear more desirable, and significantly aids the political party in charge of the decrease. However, councils also rely on council tax to fund public services in their local area.

In 2012-13, Westminster and Kensington & Chelsea, the areas with the two of the lowest council tax rates in London (and the country), parking revenues totaled £70.14 million. In the top 4 cheapest council tax areas (excluding City of London for lack of data) – Hammersmith and Fulham, Wandsworth, Westminster and Kensington and Chelsea, parking revenues totaled £105.4 million.

When wondering about how how council taxes work, or asking why they are so unfair, there is an important fundamental point to consider. Lower Council tax rates are mainly for show and the money will always come from somewhere. If you live in a borough with a higher council tax rates, the chances are that there will be fewer ‘stealth charges’ than in lower council tax areas.

In Barking and Dagenham, for example, the council tax rate of £1315 is nearly double Westminster’s £678, yet the parking revenue in Barking and Dagenham is just £2.6 million compared to Westminsters £39.7 million.

In Hammersmith and Fulham, personal trainers nannies and even dog walkers face being charged £350 – £1200 to use local parks, ‘for business purposes’. In Westminster, it has been announced that 100% of arts funding is to be cut by 2014/15.

Kingston-upon-Thames, with the highest council tax in London of £1679 claims that they chose to keep their tax high in order to take the pressure of public services. Kingston Council raises 69% of its income from residents compared to the 43% London average. It claims that this is to try to pay the money to the government which would otherwise be due in tax – protecting their public services.

Thus, it can be seen that while differences in Council tax seem, at first glance to be – at first glance – confusing and rather unfair, there is in fact an underpinning logic to them. In an era of increasing government austerity and council budget cuts, the money has to come from somewhere…