6 Top Legal Tips to Let Your London Property

If you have have decided you want to rent your London property, before starting your letting process, make sure you act in accordance with the UK legislation.

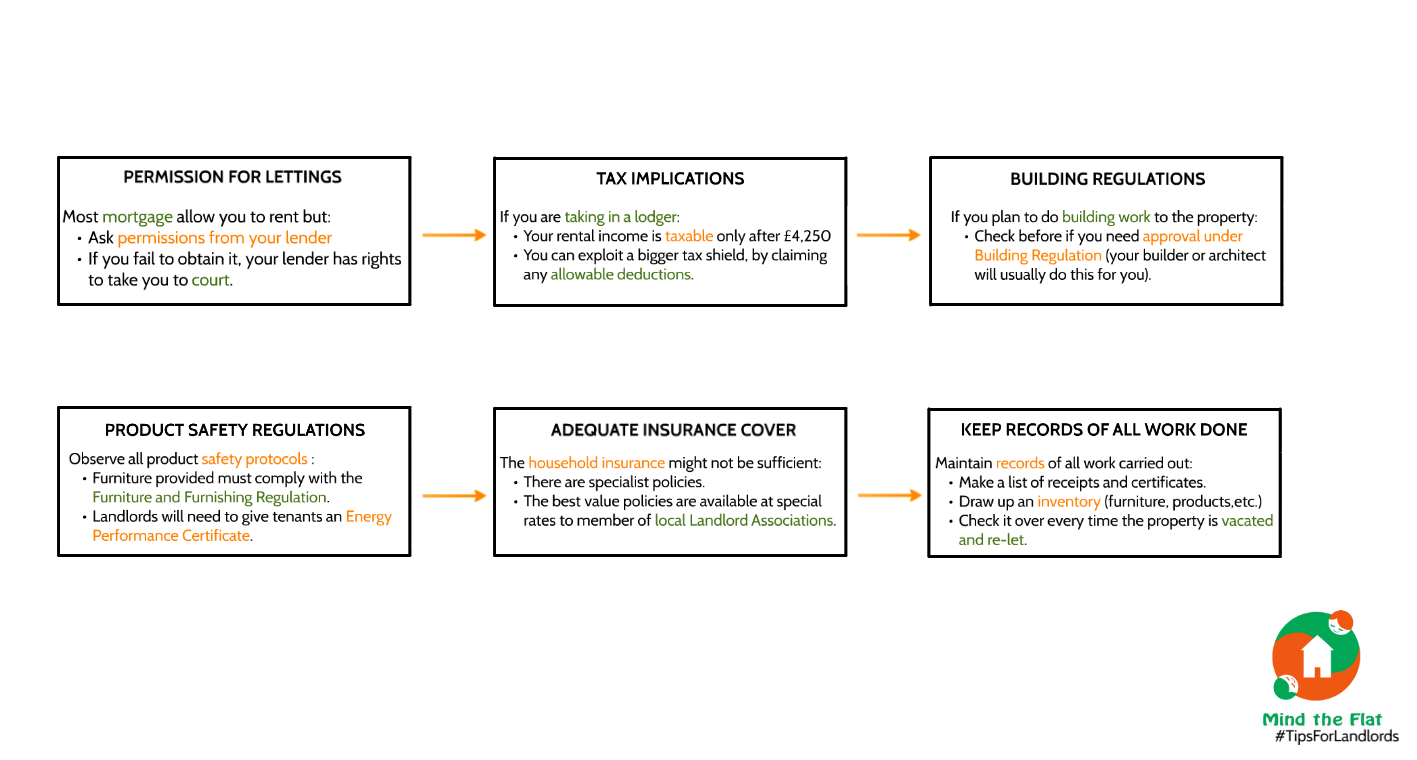

1. Permission for letting: if you have a mortgage, you should check with your lender or leasehold to be sure that you are allowed to rent your London property out. If you fail to obtain a permission for letting, your lender has rights to take you to court.

2. Tax implications: according to the UK law, you are liable to pay tax on income from property rental and you must report it through the Self-Assessment tax return if the annual rent received is greater than £2,500. However, if you are taking in a lodger, your rental income is taxable only after £4,250 and you can exploit a bigger tax shield, by claiming any allowable deductions such as cleaning, furniture and any other expenses involved in renting your spare room out.

3. Building regulations: ascertain that you get all necessary permissions to carry out any work to your property. It might need to apply for both planning permission and building regulation approval.

4. Safety regulations: when you let a property, you have to observe all product safety protocols. For instance, you should get only piece of furniture conform with regulations and with an appropriate label; you must obtain a gas safety certificate and have it checked at least once a year and you need to make sure that the provided electrical equipment are safe.

5. Get an insurance: be aware that often general household insurance are not sufficient and you should look for a specific landlord insurance. To find a trusted insurance company, Landlord Associations might be able to help you.

6. Keep records: the last but not least, maintain records of all work carried out, all receipts and certificates. If is also advisable to draw up an inventory with electrical equipment, furniture and products; you should then update the list every time the London property is re-let and you find a new tenant.